.jpeg)

The markets kicked off a jittery start to the week and the new quarter, wrestling with strong economic signals and looming questions about Federal Reserve policy moves:

Early Volatility —The markets experienced initial unease as robust economic data sparked debates about the timing of potential Federal Reserve rate cuts, leaving investors guessing about the next moves in monetary policy.

Market Recovery and Outlook — Despite early uncertainties, markets rallied at week's end, buoyed by the positive job figures that reassured investors of continued economic and corporate earnings growth. The broader sentiment remains cautiously optimistic, anchored by expectations of continued support for a bullish stock market trajectory.

The U.S. labor market remains robust, showing signs of gradual transition that may influence economic and Federal policy outlooks:

Labor Trends — The week rounded out with an encouraging jobs report indicating that the labor market is still robust. March saw an addition of 303,000 jobs, surpassing expectations and suggesting sustained economic vigor, with significant hiring in healthcare, government, construction, and leisure and hospitality sectors.

Wage Growth Impact on Inflation — Wage growth has decelerated to 4.1% in March, the lowest since June 2021. This slowdown, alongside a decreasing quit rate—which historically correlates with wage moderation—helps ease inflation pressures, important for the Fed's rate decisions.

Market Responses and Economic Implications — Positive market responses to the recent strong jobs report suggest optimism about the Federal Reserve managing a soft landing. Conversely, the resurgence in manufacturing activity, with the ISM Manufacturing index indicating expansion for the first time in 18 months, complicates prospects for rate cuts, as it might indicate sustained economic momentum.

While consumer optimism has seen some growth this year, rising fuel costs are starting to exert downward pressure on overall sentiment.

Consumer Sentiment Fluctuations — The Morning Consult's consumer sentiment index has seen a modest rise in 2024 but experienced a 0.9% week-over-week drop recently. Despite a 2.8% increase in February, sentiment edged up just 0.3% in March, and April's early declines have already cut February and March gains by half.

Rising Gas Prices — Contributing to the shifts in consumer attitudes, the average price for unleaded gas, as reported by AAA, has risen 1.3% week-over-week to $3.55 per gallon as of Thursday. Year to date, gas prices have surged by 15.2%, with further increases expected this Spring due to climbing oil prices.

March brought a breath of fresh air to the auto credit landscape, according to Cox's latest insights, highlighting nuanced shifts across the board:

Credit Landscape Broadens —The Dealertrack Credit Availability Index showed an uptick to 94.0 in March, marking a 1.1% month-over-month improvement in auto credit access, though it's still 1.5% down from the previous year. This loosening spanned all channels and lender types, with auto finance companies leading the charge.

Mixed Credit Factors — Despite overall loosening, some factors constrained consumer credit access: yield spreads widened, and term lengths contracted. Positively, the subprime share of loans and approval rates both increased, signaling mixed impacts on consumer credit availability. Notably, down payment shares remained high, unchanged but at record levels.

Lending and Borrowing Dynamics — Auto loan conditions tightened from a year-over-year perspective across most channels, with used loans from independent dealers seeing the least improvement. However, certified pre-owned loans benefited from the most significant easing. Captive auto companies were the most lenient, while auto-focused finance companies showed minimal year-over-year loosening.

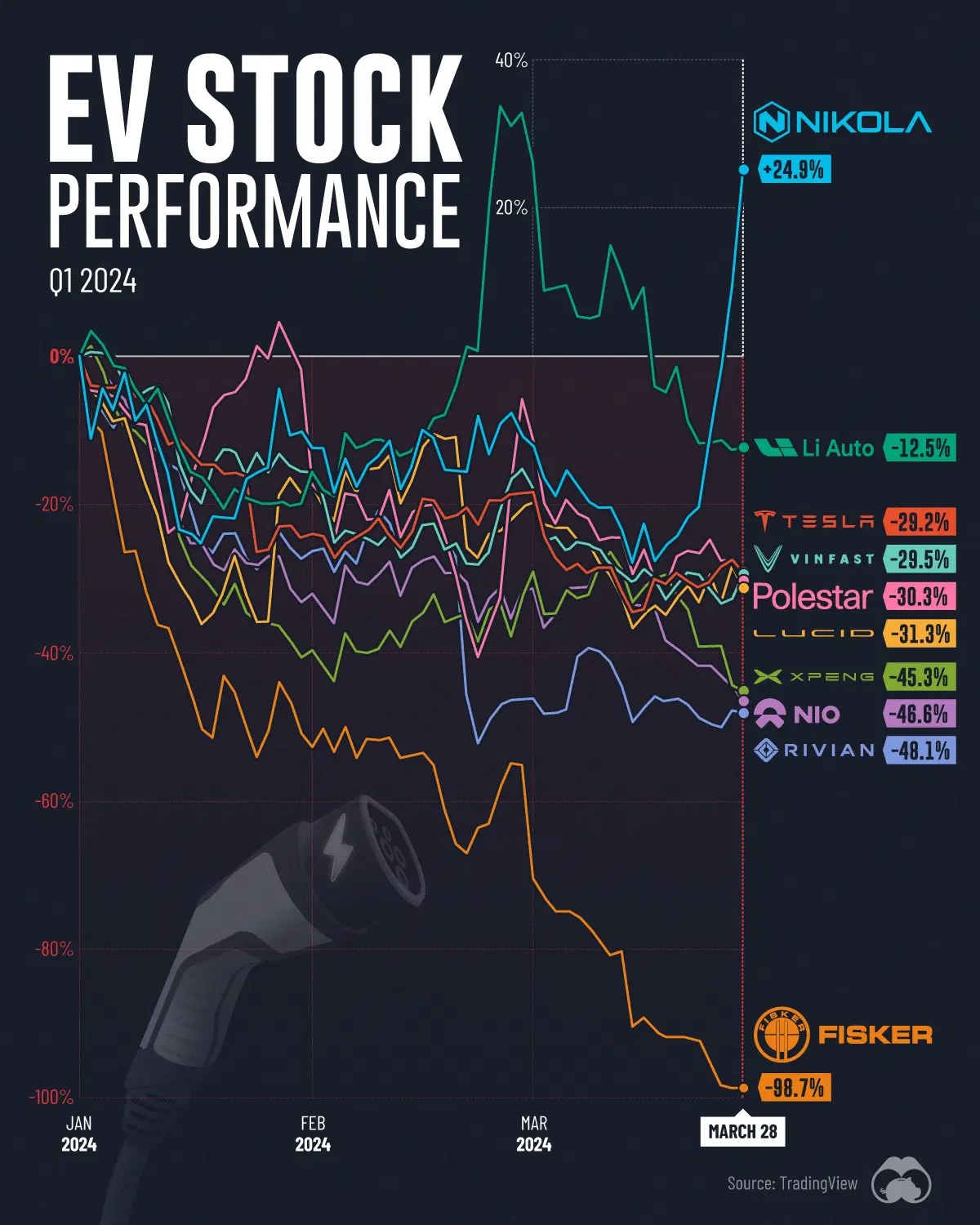

Q1 2024 has unfolded with a surprising twist for electric vehicle (EV) stocks, diverging sharply from the broader market's success:

Market Overview — Despite the S&P 500's impressive 10% gain in the first quarter of 2024, the EV sector largely didn't share in this upswing, with most pure-play EV companies—those focusing solely on electric vehicles—seeing their stocks plummet by double digits.

Notable Exceptions — Nikola and Fisker stood out dramatically from their peers, with Nikola surging by 24.9% thanks to positive developments in its hydrogen fuel cell truck business, including the launch of its first hydrogen refueling station. In stark contrast, Fisker faced a steep decline of 98.7%, culminating in its delisting from the NYSE, amid customer cancellations and product issues.

Sector Struggles — The downturn in EV stocks can be attributed to slowing demand in critical markets like the U.S. and China, posing significant challenges for startups like Rivian and Lucid that are still chasing profitability. Meanwhile, traditional automakers like Ford are increasing their focus on hybrid vehicles, drawing investor attention away from pure EV plays.